Home loan qualification calculator

Use Kotak calculator to know the loan amount you can avail based on your salary other factors. A higher DTI debt-to-income level may be allowed.

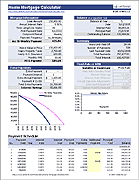

Downloadable Free Mortgage Calculator Tool

Home Loan Eligibility Calculator is an online tool that calculates your home loan eligibility in seconds.

. In the fields provided enter the original mortgage amount the annual interest rate and the original repayment term in years. Federally-insured program with specific advisors and resources. Those with good credit.

The following example shows how much time and money you can save when you make a 13 th mortgage payment every year starting from the first year of your loan. The following table shows the required income needed to have a 28 DTI front end ratio on a home purchase with 20 down for various home values. The interest is an amount your lender charges you based on your principal.

State Bank of India offers attractive interest rates on home loans starting at 805 paThe loan tenure can be extended up to 30 years ensuring a comfortable repayment periodThe processing fee on these loans is 035 of the loan amount Min. Homeowner Tax Deductions. This calculator will help you determine the remaining balance on your mortgage.

FHA 203k loans carry many of the same aspects as the regular FHA loan such as ease of qualification for. This is an estimate only. Loan-to-value ratio LTV is the percentage of your homes appraised value that is borrowed - including all outstanding mortgages and home equity loans and lines secured by your home.

Use our home loan calculator to estimate what your monthly mortgage repayments could be. Your debt-to-income ratio is calculated by adding up all of your monthly debt payments and dividing them by your gross monthly income. 30-Year Fixed Mortgage Principal Loan Amount.

Example Required Income Levels at Various Home Loan Amounts. Results are based on a debt-to-income ratio of 43. Home loan repayment calculator.

Your Guide To 2015 US. An FHA construction loan will have a few more stipulations as well such as land ownership involved in the. HELOC Home Equity Loan Qualification.

Calculator results do not reflect all loan types and are subject to individual program loan limits. The principal is the amount that youve borrowed with the home loan. For the sake of this calculation a 30-year fixed-rate home loan is presumed with a rate at 5 APR.

Available equity in the home. In the excitement of buying a home many people think more about how much house that they can afford with their monthly budget instead. Fannie Mae HomePath.

If the applicant works with a private limited company or a partnership firm the minimum educational qualification required is a Bachelor. As mentioned above banks typically allow a max LTV of 70 to 85. Whether youre refinancing or just wanting to understand how much you can afford all you have to do is enter how the amount you would like to borrow interest rate home loan term payment frequency and repayment type either principal.

For example a lenders 80 LTV limit for a home appraised at 400000 would mean a HELOC applicant could have no more than 320000 in total outstanding home. MaxRs10000 plus applicable taxesWomen borrowers are also offered an interest concession of 005 on SBI Home Loans. Minimum FHA Credit Score Requirement Falls 60 Points October 11 2018.

You can also use the calculator on top to estimate extra payments you make once a year. The three primary things banks look at when assessing qualification for a home equity loan are. Reduced down payments even as low as 35.

Free FHA loan calculator to find the monthly payment total interest and amortization details of an FHA loan or learn more about FHA loans. Before you learn how principal and interest home loan repayments differ from interest-only home loan repayments you need to understand that a home loan balance is made up of two parts. People with an excellent credit score of above 760 will get the best rates.

Key benefits of this loan compared to one you would secure at a bank include.

How Much Home Can I Afford Mortgage Affordability Calculator

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

Downloadable Free Mortgage Calculator Tool

Home Affordability Calculator For Excel

Free Financial Calculators For Excel

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Ownership Expense Calculator What Can You Afford

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Can I Afford To Buy A Home Mortgage Affordability Calculator

![]()

Foundation Home Loans Affordability Calculator

5 Best Mortgage Calculators How Much House Can You Afford

Home Loan Eligibility Affordability Calculator

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Mortgage Amortization Calculator

Home Affordability Calculator For Excel

How To Add A Mortgage Calculator In Wordpress Formidable Forms

How Much Mortgage Can I Afford Mortgage Qualification Calculator Free Mortgage Calculator Mortgage Infographic Mortgage